And because some SDIRAs for instance self-directed regular IRAs are topic to required minimal distributions (RMDs), you’ll need to plan forward to make certain that you have got sufficient liquidity to meet the rules set with the IRS.

In contrast to shares and bonds, alternative assets in many cases are harder to sell or can have rigid contracts and schedules.

When you’ve found an SDIRA company and opened your account, you may be wanting to know how to truly start investing. Being familiar with equally the rules that govern SDIRAs, and also how to fund your account, can assist to put the muse for a future of productive investing.

IRAs held at banking companies and brokerage firms present minimal investment selections to their clientele simply because they do not need the knowledge or infrastructure to administer alternative assets.

Range of Investment Alternatives: Make sure the company allows the types of alternative investments you’re enthusiastic about, for instance real estate, precious metals, or non-public fairness.

Making one of the most of tax-advantaged accounts means that you can continue to keep more of The cash that you choose to devote and gain. Based upon whether you end up picking a conventional self-directed IRA or even a self-directed Roth IRA, you've got the possible for tax-free or tax-deferred expansion, offered particular disorders are satisfied.

Prior to opening an SDIRA, it’s imperative that you weigh the potential pros and cons based upon your specific monetary objectives and danger tolerance.

Complexity and Accountability: With the SDIRA, you may have additional Handle about your investments, but Additionally you bear additional obligation.

SDIRAs are often used by arms-on traders that are ready to take on the dangers and responsibilities of choosing and vetting their investments. Self directed IRA accounts will also be perfect for traders that have specialized knowledge in a distinct segment current market they would like to invest in.

The main SDIRA principles through the IRS that investors need to be familiar with are investment constraints, disqualified persons, and prohibited transactions. Account holders will have to abide by SDIRA regulations and polices so as to preserve the tax-advantaged standing of their account.

Minimal Liquidity: A lot of the alternative assets that may be held in an SDIRA, which include property, personal fairness, or precious metals, is probably not very easily liquidated. This may be a difficulty if you have to accessibility cash swiftly.

Have the liberty to take a position in Pretty much any type of asset by using a risk profile that matches your investment system; like assets which have the likely for a higher fee of return.

In some cases, the fees connected with SDIRAs might be bigger and much more difficult than with a regular IRA. It is because in the enhanced complexity linked to administering the account.

Be answerable for the way you increase your retirement portfolio by using your specialized knowledge and pursuits to take a position in assets that in shape using your values. Acquired knowledge in property or personal equity? Utilize it to aid your retirement planning.

Imagine your Good friend may be starting off the next Facebook or Uber? Having an SDIRA, you'll be able to spend money on leads to that you think in; and likely take pleasure in better returns.

Entrust can aid you in acquiring alternative investments along with your retirement resources, and administer the obtaining and offering of assets that are generally unavailable by way of banks and brokerage firms.

Set just, if you’re hunting for a tax effective way to make a portfolio that’s a lot more personalized for your passions and know-how, an SDIRA could possibly additional hints be The solution.

This contains comprehension IRS rules, controlling investments, and averting prohibited transactions that would disqualify your IRA. An absence of information could lead to pricey mistakes.

Customer Assist: Try to look for a provider that offers dedicated help, like use of proficient specialists who will respond to questions on compliance and IRS procedures.

Emilio Estevez Then & Now!

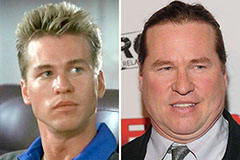

Emilio Estevez Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Batista Then & Now!

Batista Then & Now!